Can you trust the headlines? Real talk about the 2025 Housing Market

You’ve probably seen the headlines:

“Recession is looming.” “The housing market is cracking.” “Builders are overbuilding like it’s 2008 again.”

But when you dig in, the truth is this: the news often does more to terrify than clarify. Here’s what you really need to know about what’s happening nationally—and right here in Charleston.

1. Yes, There’s Some Economic Anxiety—But That Doesn’t Mean a Crash

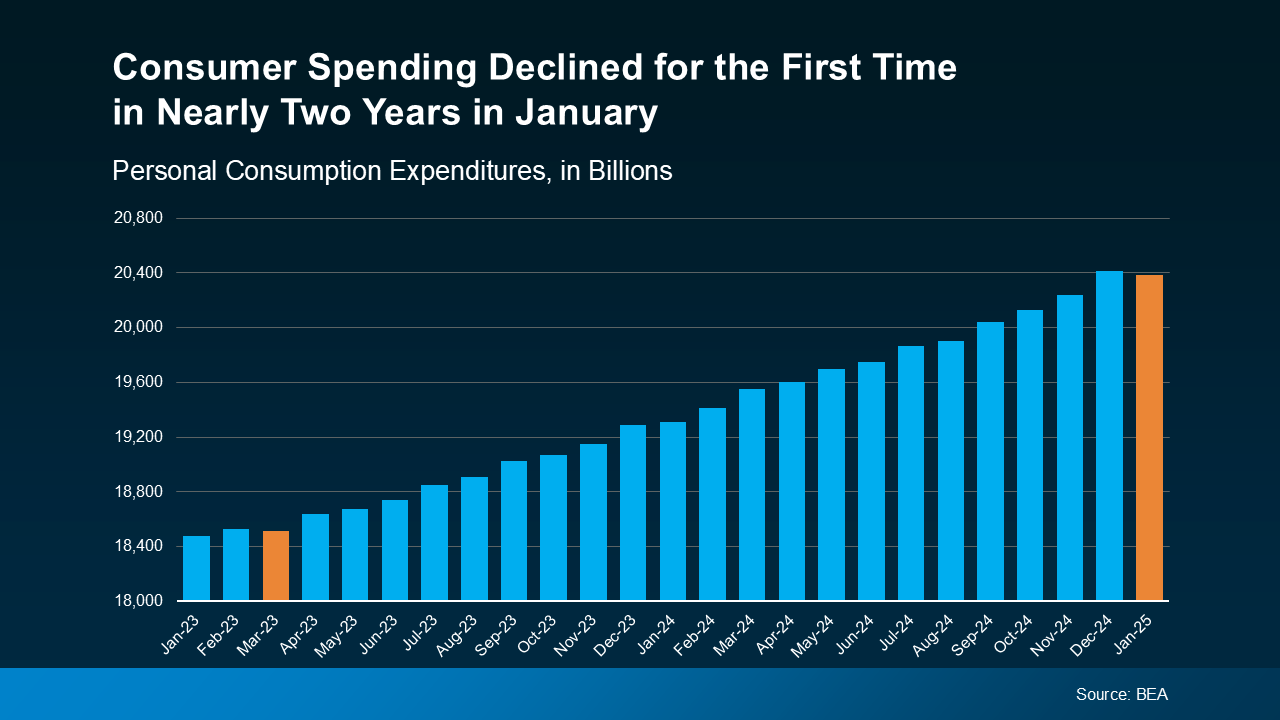

Consumer spending dipped in January for the first time in nearly two years. That’s often a signal people are feeling unsure—maybe about jobs, maybe about the broader economy. But this doesn’t automatically mean a recession is happening.

In fact, most experts—like Mark Zandi, Chief Economist at Moody’s—say the chance of a recession is around 35%. That’s higher than normal, but it’s still more likely not to happen than to happen.

2. Headlines Are Misleading Without Context

Let’s talk about that viral headline: “6.1 million Americans are behind on their mortgages.”

Sounds alarming—but it’s missing key context. That number refers to multifamily properties, not the single-family homes most buyers and sellers are dealing with. In reality, delinquencies on single-family homes are still at pre-pandemic norms.

So if you’re seeing headlines that make it sound like 2008 all over again—take a breath. Look deeper.

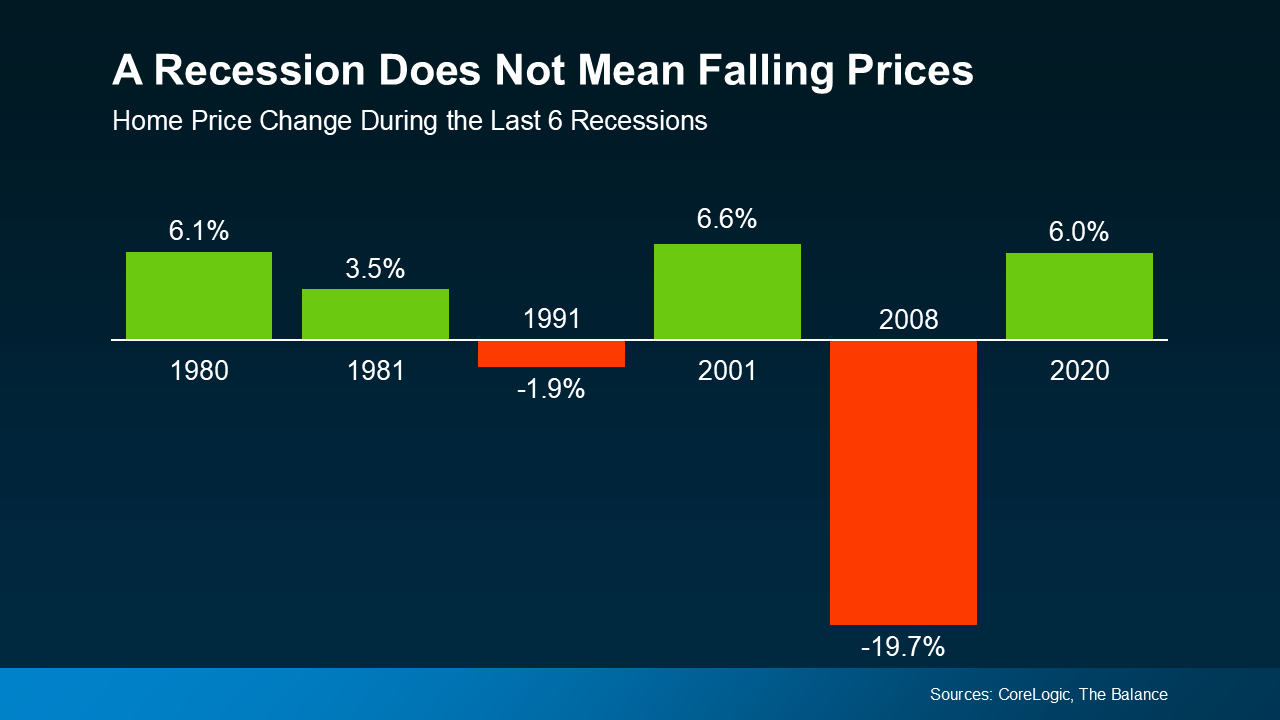

3. A Recession Does Not Equal a Housing Crash

Here’s the biggest myth out there: that a recession means home prices will crash. That’s just not true.

Looking at the last six recessions, home prices actually went up in four of them. The only major drop? 2008. And that wasn’t a regular recession—it was caused by the housing market itself.

If a recession does happen, history says we’re more likely to see stable or even rising home prices—not a crash.

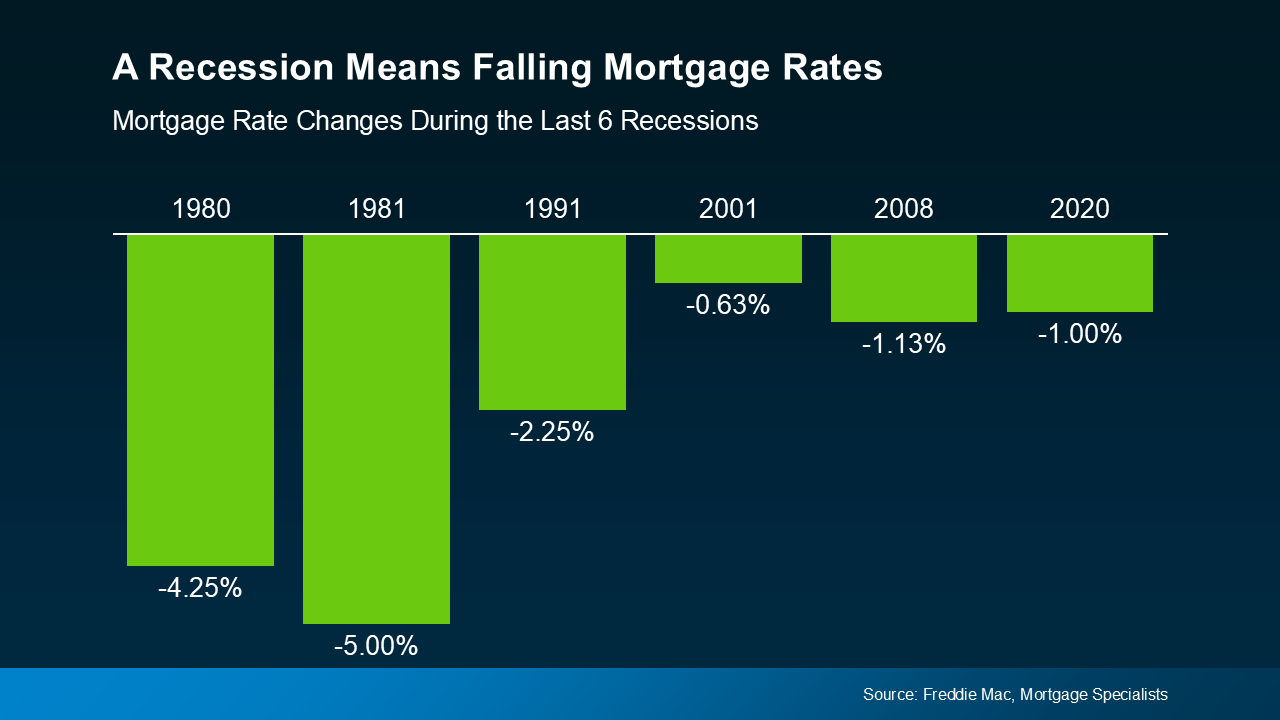

4. Recession = Lower Mortgage Rates

If you’re buying, here’s the upside: mortgage rates often come down during a recession. It’s not something anyone hopes for, but if it happens, it could create an opportunity for well-positioned buyers to lock in lower rates and better monthly payments.

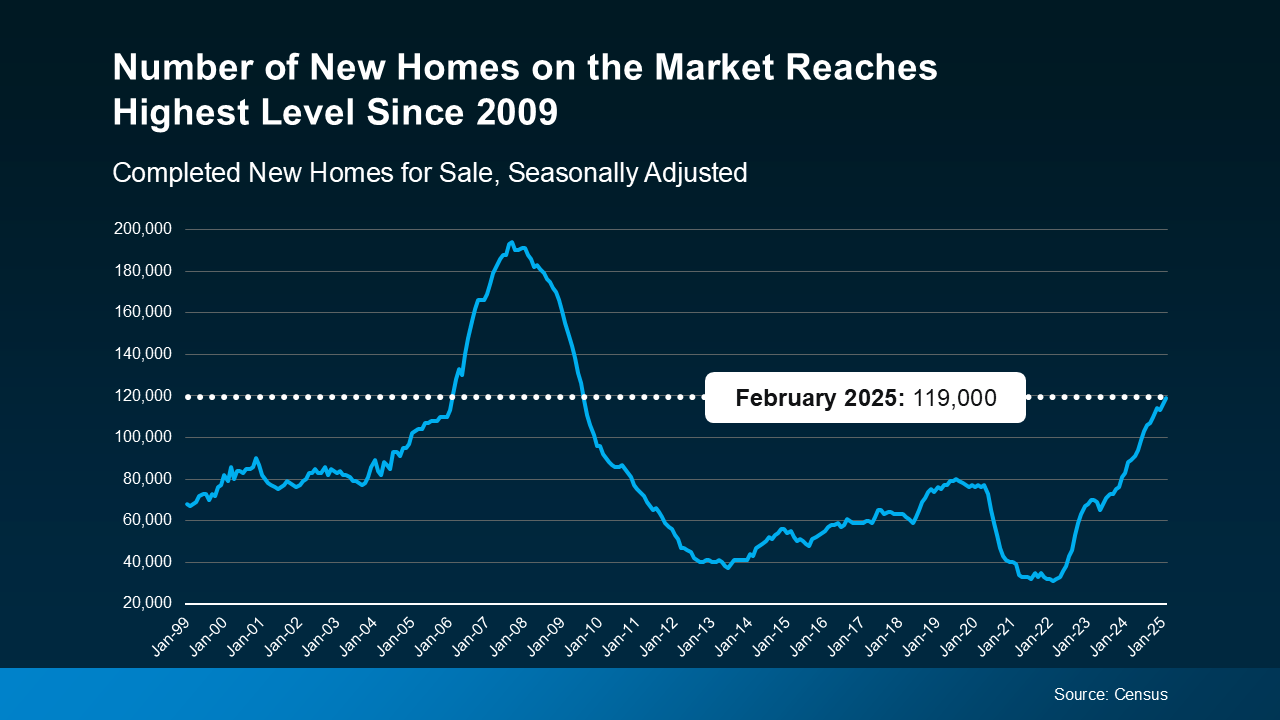

5. New Construction Is Up—But That’s a Good Thing

You might see headlines saying we’ve reached 2009 levels of new home inventory. Here’s what they don’t mention: we’ve been underbuilding homes for over 15 years. Builders are finally catching up—not overbuilding like they did before the crash.

More homes on the market = more options for buyers. And builders are offering incentives right now to move that inventory. This is not 2008—this is a market correcting a long-term supply issue.

What This Means for You

Whether you're thinking about buying, selling, or just waiting it out, don’t let fear-based headlines make your decisions for you. The truth is, the housing market is stable, not scary. Prices aren’t crashing, rates may come down, and new home options are expanding.

This isn’t about timing the market perfectly. It’s about understanding the full picture and making a smart, confident move that fits your life.

If you're trying to make sense of what this all means for your personal goals, I’m always happy to chat. No pressure—just real talk.

Need help figuring out your next move? Let’s talk. I’ll help you sort through the data, tune out the noise

Categories

Recent Posts